pay indiana state estimated taxes online

For more information visit INTIME. To get started click on the appropriate link.

Prepare Efile Your Indiana State Tax Return For 2021 In 2022

To determine if these changes will affect your 2021 estimated tax payments see Estimated tax law changesIf you need to adjust already-scheduled payments due to the new brackets and rates you may cancel and resubmit.

. You can download or print current or past-year PDFs of Form ES-40 directly from TaxFormFinder. To file andor pay business sales and withholding taxes please visit INTIMEdoringov. Ready to access the Indiana Taxpayer Information Management Engine INTIME.

You should also know the amount due. Special Fuel - SFT. Make a Payment via INTIME INTIME user guides are available if needed.

Select the payment type 2021 MI-1040 for the following type of payments. Get started by creating your logon at INTIMEdoringov. 0101 Step 2 Pay online using MasterCard Visa or Discover at the Indiana state government ePay website see Resources.

01-20-2022 Individual Income Tax Filing Opens Jan. Mail a check or money order with your return. The Indiana Department of Revenues DOR new online e-services portal INTIME now offers customers the ability to manage their tax account s in one convenient.

If you expect to have income during the tax year that. 11-18-2021 DORs Columbus Office Moving to New Location the Day Before Thanksgiving. The 2021-2022 New York State budget replaced the highest personal income tax bracket and rate for 2021 with three new brackets and rates which may impact estimated tax payments.

Make a payment using the online payment option on the departments website. Make a same day payment from your bank account for your balance payment plan estimated tax or other types of payments. When prompted provide your taxpayer identification number or Social Security number and your liability number or warrant number.

To make an estimated tax payment online log on to wwwingovdor4340htm. Submit your application by going to Revenue. View the amount you owe your payment plan details payment history and any scheduled or pending payments.

Make a Payment - Contact Information. You must provide the contact information for the individual filing this return. Create an INtax Account.

12-21-2021 Most Indiana Individual Income Tax Forms Now Online. Before making or scheduling an estimated tax payment review Estimated tax law changes to determine if your 2021 estimated tax payments are affected by. Go to the departments tax forms to complete and print the interactive Form 1-ES Voucher.

The 2021-2022 New York State budget replaced the highest personal income tax bracket and rate for 2021 with three new brackets and rates. 081 average effective rate. When To Pay Estimated Taxes For estimated tax purposes the year is divided into four payment periods.

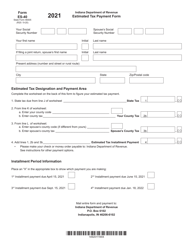

Estimated payments will apply to the quarter in which. Choose to pay directly from your bank account or by credit card service provider fees may apply. We last updated the Estimated Tax Payment Voucher in January 2022 so this is the latest version of Form ES-40 fully updated for tax year 2021.

To make an estimated tax payment online log on to DORs e-services portal the Indiana Taxpayer Information Management Engine INTIME at intimedoringov. Go to Your Account. Indiana Form ES-40 Estimated Tax Payment.

You will only need to provide your contact information once by signing up for a MyTax Missouri account. Estimated payments may also be made online through Indianas INTIME website. INTIME offers a quick safe and secure way to submit payments at your convenience.

Payment of estimated taxes Estimated payments can be made by one of the following methods. Make a payment. Will not have Indiana tax withheld or If you think the amount withheld will not be enough to pay your tax liability and You expect to owe more than 1000 when you file your.

You may send estimated tax payments with Form 1040-ES by mail or you can pay online by phone or from your mobile device using the IRS2Go app. Sign In to Pay and See Your Payment History. Filling out Form ES-40.

To file andor pay business sales and withholding taxes please visit INTIMEdoringov. Payment for tax due on the 2021 MI-1040 Payment in response to a 2021 Proposed Tax Due letter sent to you by the Michigan Department of Treasury Michigan Estimated Income Tax for Individuals MI-1040ES Select the payment type 2022 Estimate. There are several options available for making estimated payments.

INtax - Log In or Create new Account INtax will continue to provide the ability to file and pay for the following tax types until July 2022. Tax Liabilities and Case Payments. Indiana Department of Revenue is launching a new e-services portal to manage your corporate and business tax obligations.

12-14-2021 Individual Income Tax Rates to Rise in Three Indiana Counties Effective Jan. Electronic payment using Revenue Online. Will not have Indiana tax withheld or If you think the amount withheld will not be enough to pay your tax liability and.

Call the department at 608 266-2486 to request tha t we mail vouchers to you. If you expect to have income during the tax year that. Using a preprinted estimated tax voucher that is issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated tax.

Motor Fuel - MFT. Did you know that DORs online e-services portal INTIME allows individuals to pay their estimated taxes owed to DOR or view their payment history 247. DOR Online Services Pay Taxes Electronically INTIME INTIME provides access to manage and pay individual income and various corporate and business tax obligations.

323 statewide flat rate counties may charge additional rates Sales tax. The individual must be authorized to discuss the confidential information provided in the return. 32 cents per gallon of regular gasoline and 53 cents per gallon of diesel.

Gasoline Use Tax - GUT. As of September 7 2021 Individual estimated payments can be made using INTIME. Indiana State Tax Quick Facts.

Indiana State Taxes For 2022 Tax Season Forbes Advisor

Dor Your State Tax Dollars At Work

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

Payment Plan Agreement Template Word New 8 Installment Payment Contract Template Lesson Plan Template Free Letter Template Word How To Plan

Indiana Sales Tax Small Business Guide Truic

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Indiana State Tax Information Support

Individual Income Tax Payers Added To Indiana Online Tax Portal Intime

Indiana Real Estate License Requirements Pdh Real Estate

Alaska State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller