where do i pay overdue excise tax in ma

Jeffrey Jeffrey Inc. If the excise continues to be outstanding the.

How To Pay Your Motor Vehicle Excise Tax Boston Gov

Payment at this point must be made through our Deputy.

. Payment by cash check or money order may be made in person at. 40 - Year 3. Once you enter your NAME please CLICK one of the options below to continue.

Hopedale MA 01747 508-473-9660 Visit their website here. Is located at 137 Main St Ware MA. We strongly encourage you to pay your Excise tax bills online.

Payment at this point must be made through our Deputy. To START please provide the LAST NAME or COMPANY NAME as it appears on the BILL you received. License Bill Type Parking Find your bill using your license number and date of birth.

How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal. 10 - Year 5. 90 - Year 1 where the model year of vehicle is the same as the Excise Tax year 60 - Year 2.

Click here for details Collecting Delinquent Taxes MLC Mail-In Request Form MLC Request Motor Vehicle Excise Online Payments Taxes Water Sewer Trash Parking Ticket. If you dont make your payment within 30 days of the date the City issued the. Options for Paying Your Bills Pay Your Tax Bills Online Real Estate Taxes Tax Due Dates Transfer Station Stickers Bags Contact Info Phone.

All Massachusetts residents who own and register a motor vehicle must pay the motor vehicle excise annually. Please contact our Deputy Collector Jeffery Jeffery 137 Main street Ware MA 01082-0720. They will accept a money order or.

If you are unable to find your. How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal. How do I pay overdue Excise Taxes that have been marked at the Registry of Motor Vehicles for non-renewal.

Please note for new vehicles released in the. Please do not mail cash. Payment at this point must be made through our Deputy Collector Kelley.

The city or town where the vehicle is principally garaged levies the excise. Current Fiscal Year Tax Rate Motor Vehicle Excise Tax Online Payments Request for Tax Information Municipal. Bill Search Please select a search method using one of the following options.

Box 720 Ware MA 01082. To find out if you qualify call the Taxpayer Referral and Assistance Center at 617-635-4287. Upon failure to pay within 30 days of the notice of warrant the deputy collector will make a service of warrant the charge for which is 17.

Their mailing address is PO. Please contact the treasuercollectors office or our Deputy Collector Kelly. How do I pay for overdue excise taxes that have been sent to Jeffery Jeffery for collections.

Office of the City Treasurer in City Hall 375 Merrimack Street 1st Floor Room 30 Lowell MA. How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal. 25 - Year 4.

They can be reached at 413 967-9941. How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal.

Motor Vehicle Excise Taxes Royalston Ma

Coronavirus Weymouth Extends Tax Payment Due Dates Weymouth Ma Patch

California Targets Cannabis Businesses Over Unpaid Taxes

Treasurer Collector Andover Ma

Massachusetts Sales Use Tax Guide Avalara

Mass Lawmakers Want To Limit Tax Rebates For Wealthy Residents Masslive Com

How To Make A Payment Seekonk Ma

Motor Vehicle Excise Taxes Royalston Ma

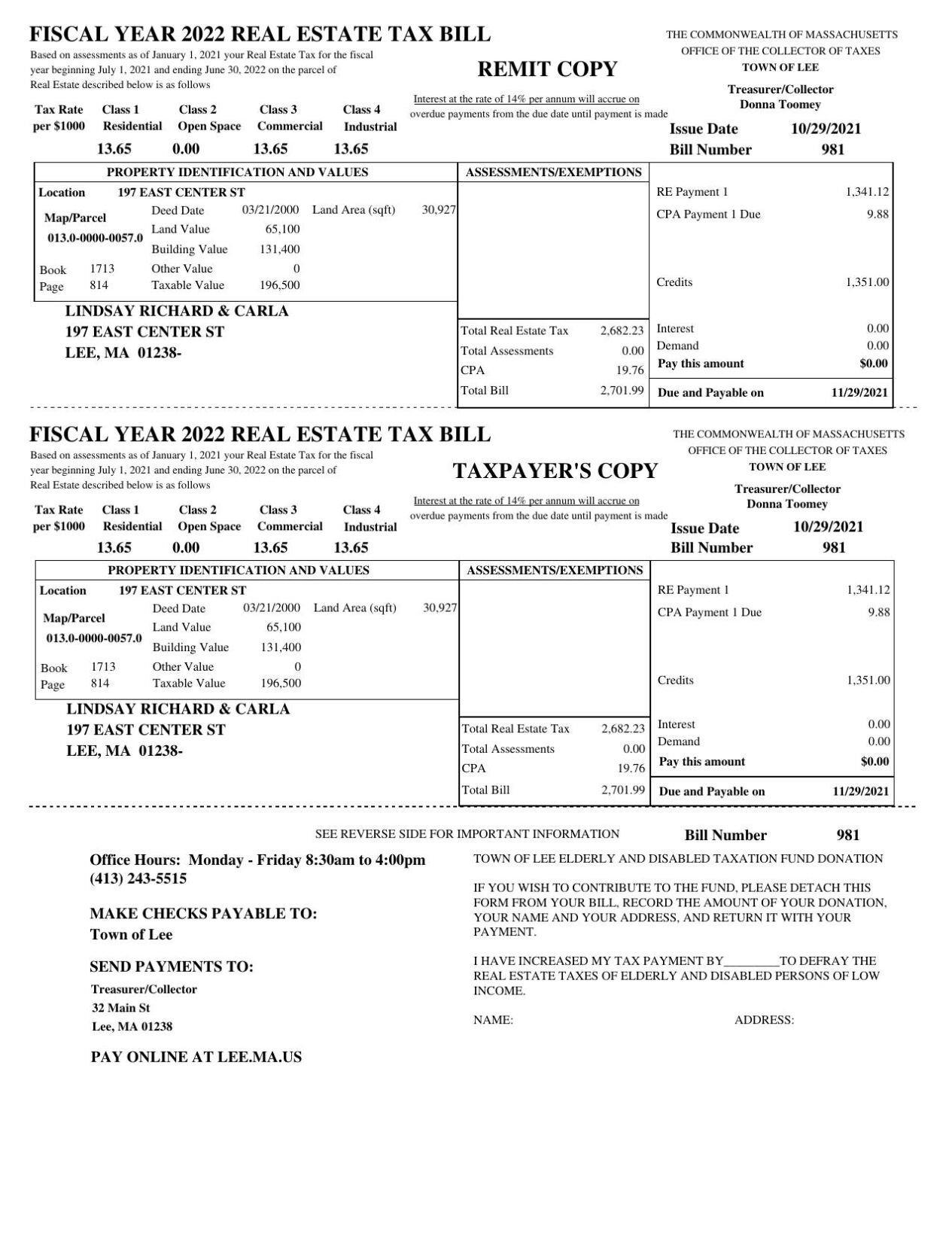

6 Things To Know About Your Property Tax Bill If You Own A Home In Berkshire County Local News Berkshireeagle Com

Wtf Massachusetts R Massachusetts

2022 Motor Vehicle Excise Tax Bill Mailed Fairhavenma

Excise Taxes Excise Tax Trends Tax Foundation

Motor Vehicle Excise Gardner Ma

Records Show Tax Woes For At Least One Top Candidate For Boston Mayor The Boston Globe

Excise Taxes Excise Tax Trends Tax Foundation

City Of Methuen On Twitter Excise Tax Excise Tax Payments Are Overdue A Fee Will Be Added To Your Account If Not Paid By April 28 2022 Pay Online At Https T Co On1eln8bfw Or